Packing Machine Depreciation Rate . equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. If a company invests in. understanding plant and machinery depreciation is key for good financial management and tax savings. over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. It's commonly used for taxes and similar business financial documentation. depreciation is one process by which equipment values may be estimated. double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice.

from www.bartleby.com

equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. If a company invests in. It's commonly used for taxes and similar business financial documentation. understanding plant and machinery depreciation is key for good financial management and tax savings. depreciation is one process by which equipment values may be estimated. double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice.

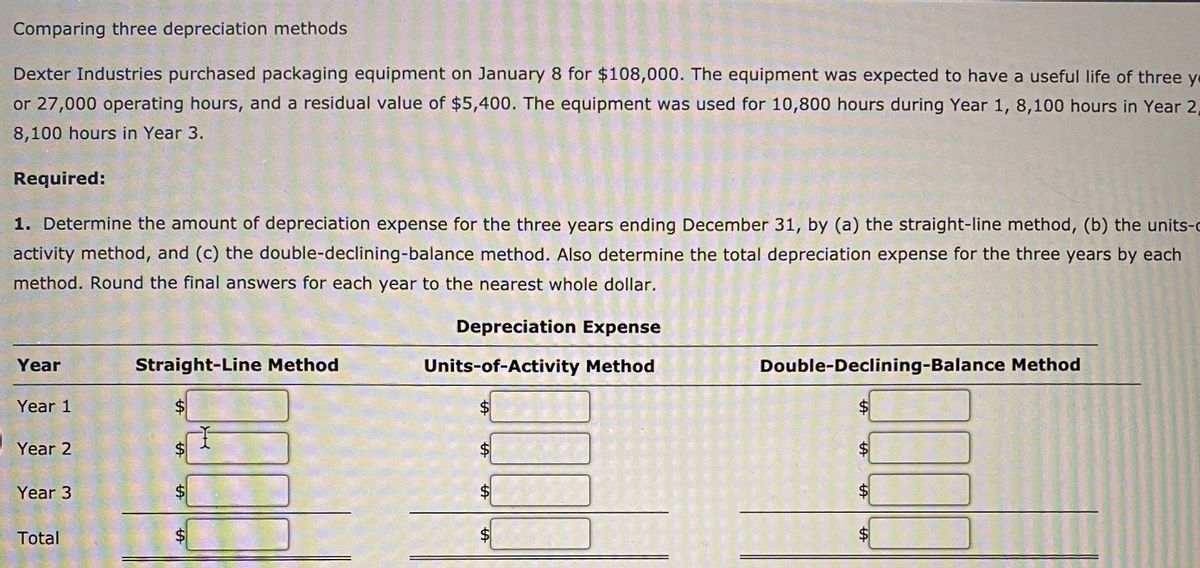

Answered Comparing three depreciation methods… bartleby

Packing Machine Depreciation Rate over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. It's commonly used for taxes and similar business financial documentation. depreciation is one process by which equipment values may be estimated. equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice. understanding plant and machinery depreciation is key for good financial management and tax savings. If a company invests in. over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or.

From sorrellcuillin.blogspot.com

Depreciation percentage on equipment SorrellCuillin Packing Machine Depreciation Rate over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. understanding plant and machinery depreciation is key for good financial management and tax savings. It's commonly used for taxes and similar business financial documentation. according to the income tax act, certain depreciation rates. Packing Machine Depreciation Rate.

From www.functionx.com

Lesson 45 Introduction to Counting and Looping Packing Machine Depreciation Rate If a company invests in. depreciation is one process by which equipment values may be estimated. over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. understanding plant and machinery depreciation is key for good financial management and tax savings. according to. Packing Machine Depreciation Rate.

From www.youtube.com

10 Depreciation Machine Hour Method Problem 11 By Saheb Academy YouTube Packing Machine Depreciation Rate according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. depreciation is one process by which equipment values may be estimated.. Packing Machine Depreciation Rate.

From www.youtube.com

6 two machines Depreciation accounting straight line method gain or loss on disposal of Packing Machine Depreciation Rate over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. understanding plant and machinery depreciation is key for good financial management and tax savings. If a company invests in. according to the income tax act, certain depreciation rates are applicable in case a. Packing Machine Depreciation Rate.

From www.chegg.com

Solved Comparing three depreciation methods Dexter Packing Machine Depreciation Rate depreciation is one process by which equipment values may be estimated. If a company invests in. equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. It's commonly used for taxes and similar business financial documentation. according to the income tax act, certain depreciation rates. Packing Machine Depreciation Rate.

From willsanellis.blogspot.com

Heavy equipment depreciation calculator WillsanEllis Packing Machine Depreciation Rate equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice. according to the income tax act, certain depreciation rates are applicable in case a company. Packing Machine Depreciation Rate.

From dxorzcdfs.blob.core.windows.net

Useful Life Of Equipment For Depreciation at Stephen Curtis blog Packing Machine Depreciation Rate equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice. understanding plant and machinery depreciation is key for good financial management and tax savings. It's. Packing Machine Depreciation Rate.

From cebbwkir.blob.core.windows.net

Restaurant Equipment Depreciation Life 2020 at Christopher blog Packing Machine Depreciation Rate understanding plant and machinery depreciation is key for good financial management and tax savings. If a company invests in. double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice. It's commonly used for taxes and similar business financial documentation. over the course of a machine's lifespan, it. Packing Machine Depreciation Rate.

From www.babelsoftco.com

Equipment Depreciation Report Babelsoftco Packing Machine Depreciation Rate It's commonly used for taxes and similar business financial documentation. depreciation is one process by which equipment values may be estimated. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. equipment depreciation is the gradual decrease in the value of physical assets. Packing Machine Depreciation Rate.

From www.youtube.com

Machine hour Rate and Mileage method of Depreciation, Accounting Lecture Sabaq.pk YouTube Packing Machine Depreciation Rate over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. It's commonly used for taxes and similar business financial documentation. depreciation is one process by which equipment values may be estimated. double declining balance is the most widely used declining balance depreciation method,. Packing Machine Depreciation Rate.

From noticiasmaquina.blogspot.com

Como Calcular La Depreciacion De Una Maquina Noticias Máquina Packing Machine Depreciation Rate equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. understanding plant and machinery depreciation is key for good financial management. Packing Machine Depreciation Rate.

From www.fastcapital360.com

How to Calculate MACRS Depreciation, When & Why Packing Machine Depreciation Rate depreciation is one process by which equipment values may be estimated. over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn out or. understanding plant and machinery depreciation is key for good financial management and tax savings. It's commonly used for taxes and similar business. Packing Machine Depreciation Rate.

From www.online-accounting.net

Straight Line Depreciation Method Online Accounting Packing Machine Depreciation Rate It's commonly used for taxes and similar business financial documentation. depreciation is one process by which equipment values may be estimated. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. double declining balance is the most widely used declining balance depreciation method,. Packing Machine Depreciation Rate.

From exocjpduo.blob.core.windows.net

Depreciation Calculator With Percentage at Stuart Kelley blog Packing Machine Depreciation Rate depreciation is one process by which equipment values may be estimated. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. over the course of a machine's lifespan, it gradually decreases in value and approaches its bottom end value as it becomes worn. Packing Machine Depreciation Rate.

From www.bartleby.com

Answered Comparing three depreciation methods… bartleby Packing Machine Depreciation Rate double declining balance is the most widely used declining balance depreciation method, which has a depreciation rate that is twice. understanding plant and machinery depreciation is key for good financial management and tax savings. according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal. Packing Machine Depreciation Rate.

From farmdocdaily.illinois.edu

Accelerated Depreciation and Machinery Purchases farmdoc daily Packing Machine Depreciation Rate according to the income tax act, certain depreciation rates are applicable in case a company purchases a plant or machinery during a fiscal year. depreciation is one process by which equipment values may be estimated. equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage.. Packing Machine Depreciation Rate.

From dxozldkxu.blob.core.windows.net

Fax Machine Depreciation Rate at William Lopez blog Packing Machine Depreciation Rate equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. understanding plant and machinery depreciation is key for good financial management and tax savings. If a company invests in. depreciation is one process by which equipment values may be estimated. according to the income. Packing Machine Depreciation Rate.

From www.youtube.com

Lesson 7 video 3 Straight Line Depreciation Method YouTube Packing Machine Depreciation Rate understanding plant and machinery depreciation is key for good financial management and tax savings. depreciation is one process by which equipment values may be estimated. equipment depreciation is the gradual decrease in the value of physical assets over time due to wear and tear from regular usage. It's commonly used for taxes and similar business financial documentation.. Packing Machine Depreciation Rate.